We were told it would be a “big” budget, but it wasn’t.

Unless you’re counting big savings, big public sector cuts, and a big hole in the finances of millions of families dependent on state assistance to live. And alarmingly, with his unquenchable thirst for fiscal orthodoxy, George Osborne has slashed at a new demographic to make savings.

The Conservative Party opposed Labour’s mansion tax, reluctantly raised capital gains tax and introduced the triple lock pension system to protect the life savings of the elderly. This was seen as cementing the two key pillars of Conservatism – individual freedoms and the right to property. After all, it was argued, many pensioners and property-owners fought for this country in twentieth-century wars, and so they deserve a fair deal from the state in their old age. That’s non-contentious; many voters across the political spectrum agree that war heroes are under-appreciated by our society.

But within that argument – made by the Tories in the last Parliament – is one logical link that casts shadow on the budget. The past actions of our citizens determine the deal they’re given by the Treasury. You fight for Britain, and the government gives you a pension that rises by the rate of average earnings, inflation or 2.5%. You spend your life honestly paying off a mortgage which epitomises household traditionalism, and the Tories try to suppress the tax you pay when you sell your house or pass it to your children.

Naturally, then, it makes total sense that the people hit the hardest by the Chancellor’s budget are those who are ultimately responsible for the 2008 crisis which necessitates such savage austerity. The poor, and the students.

Hang on. As far as I was aware, the 2008 crisis was caused mostly by an irresponsible lending policy of household banks, downright dangerous investment decisions by commercial institutions, too-lax banking regulation and liquidity controls by central banks, a worldwide dependency on credit and demand spiralling out of control. And to my knowledge, neither students nor the poor are well known for their population of investment banks, or their huge spending. It’s not sensible to punish the innocent for bad financial management of the rich.

Two things must be made clear. Firstly, it is still in fierce dispute that austerity is a legitimate policy of recession-recovery. The neo-Keynesian school of economics which proposes demand stimulation by increased public spending (as in 2008-10 by Labour) is far from defunct. In fact, many countries exhibiting higher levels of state control over their economies in the aftermath of 2008 are experiencing excellent growth. Iceland, for instance, has recovered impressively due to an aggressive policy of state takeovers and demand control. So it should not be taken as gospel that the only solution to a crisis is to allow the gears of government spending to seize up. The Tories have done well to aggregate debt and deficit, and growth and inflation. The result? Many people are confused about the economy and trust David Cameron when he intones solemnly: “the answer to a debt crisis cannot be more debt”. If only it were that simple.

Secondly, the ultimate purpose of public spending is not just to provide bin collection and traffic cones, hospitals and school lunches. The government spends money on schemes which promote social ‘goods’, or the creation of resources which are worthwhile but impossible without public assistance. One such example of this is the university maintenance grant. By providing a means-tested cash sum to the student each year, the government demonstrates to the student that it believes there is an innate value and beauty to education, and that it is willing to fund some of it for free. For many prospective students, myself included, an admittedly meagre maintenance loan was reassurance that the state believed in me and my degree. Now, all student finance will be operated through borrowed money, with the Treasury acting like a suspiciously benevolent loan shark. It’s just another way that the government has saved money from the backs of those with little to give.

But alas, Osborne responds, the new Living Wage of £7.20/h to be introduced by April 2016 is to help those on low incomes. Families, he claims, will be able to earn much more than they currently do through the Minimum Wage system. However, he ignores the simultaneous cuts he makes to the benefit allowance of the very poorest in society. Many workers who have part-time contracts to look after children (or because full-time work is scarce) require state benefits to top up wages to live. These, under the first Tory budget since the 1990s, will be slashed to make room for more cuts. Ultimately, many working families – the demographic the Conservatives tried to hard to entice at this year’s general election – will be paying more tax or receiving fewer benefits. That’s not going to win Osborne votes at the Tory leadership.

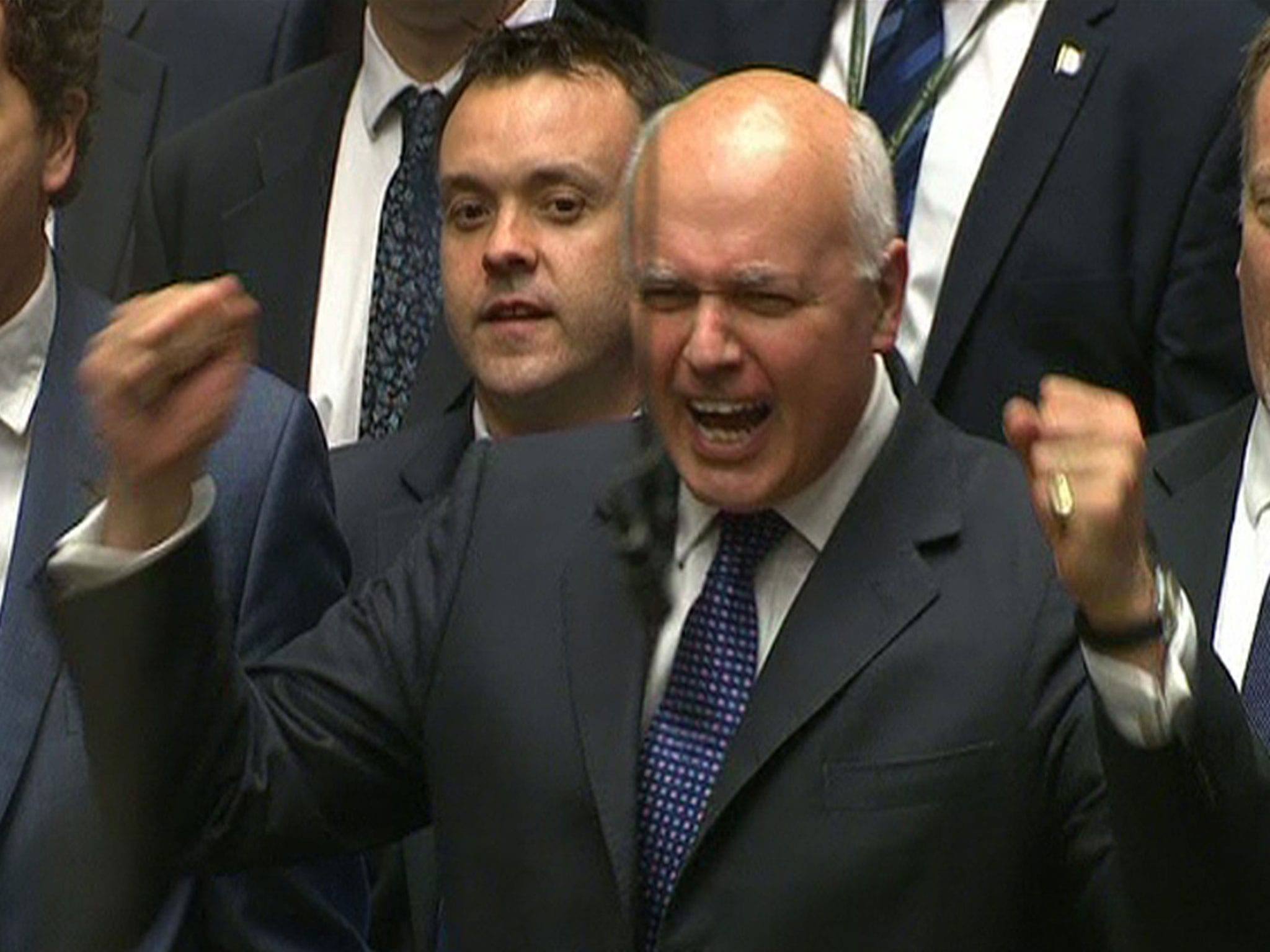

As Iain Duncan Smith, the oft-slated DWP Secretary cheered in the Commons, many students and minimum wage workers turned away in disgust. The hand of Osborne giveth, and the hand taketh away.

Words by Tony Diver

I don’t know if you’ve heard of this country, but what they’ve done is spent a hell of a lot and had very low taxes by borrowing a lot.

I think they’re called Greece?

Might want to look their situation up.

The situation in Greece is fundamentally different. The structure of their finances, their labour productivity and the excess borrowing caused by cheap rates offered to Eurozone members are all factors that don’t affect the UK. The comparison made by Tories is a cheap, scaremongering tactic.